Irs Form 1040 Schedule E Instructions 2025

Irs Form 1040 Schedule E Instructions 2025. If you earn rental income on a home or building you own, receive royalties or. 2025 tax returns are expected to be due in.

Use one of these worksheets to calculate your required minimum distribution. While real estate tax can be.

Irs Form 1040 Schedule E Instructions 2025 Images References :

Source: form-1040-schedule-e-instructions.com

Source: form-1040-schedule-e-instructions.com

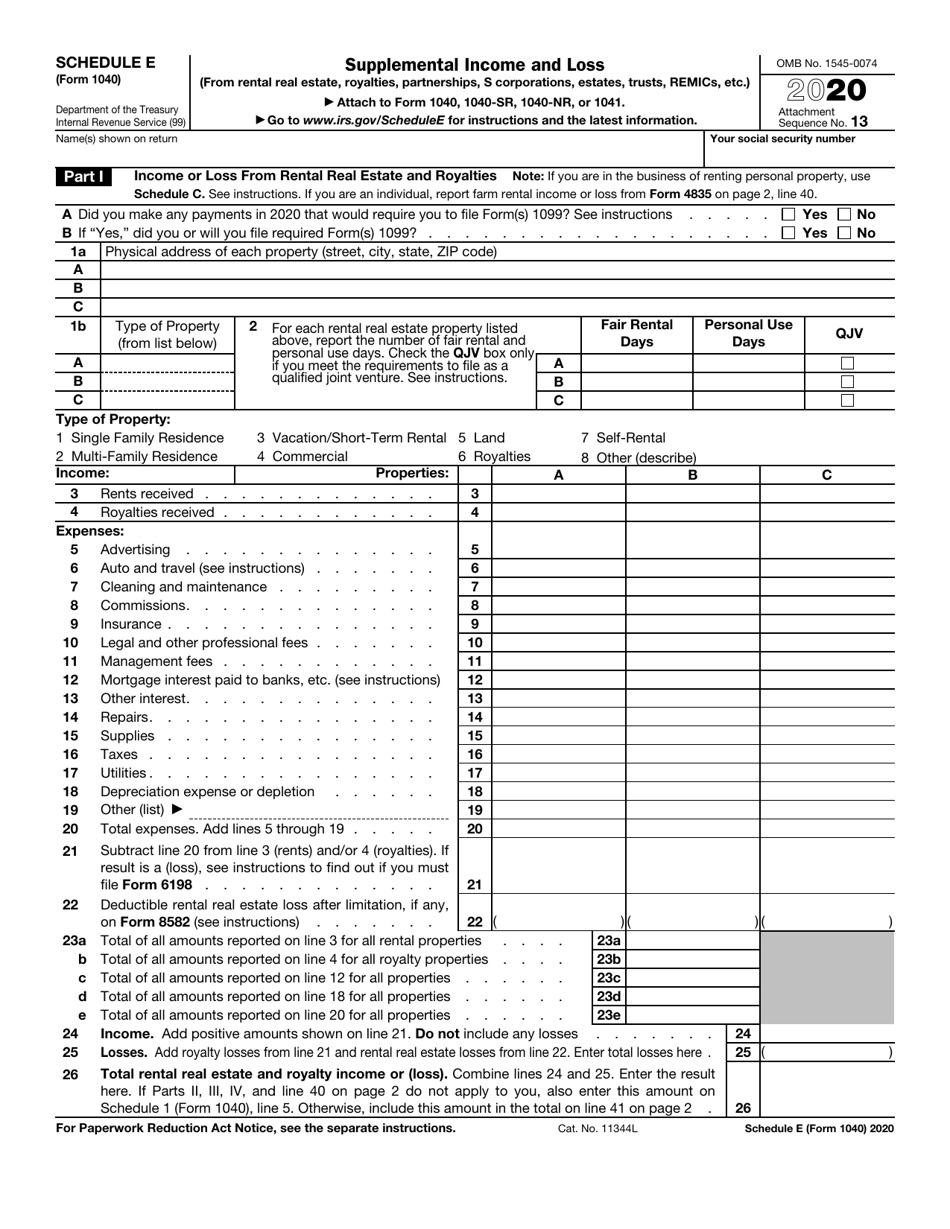

Schedule E Instructions Fill out and Edit Online PDF Template, The irs instructions indicate specific types of income activities that individual taxpayers should report using schedule c forms instead of the schedule e tax form.

Source: www.sfa.msstate.edu

Source: www.sfa.msstate.edu

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax, The irs has announced the annual inflation adjustments for the year 2025,.

Source: www.templateroller.com

Source: www.templateroller.com

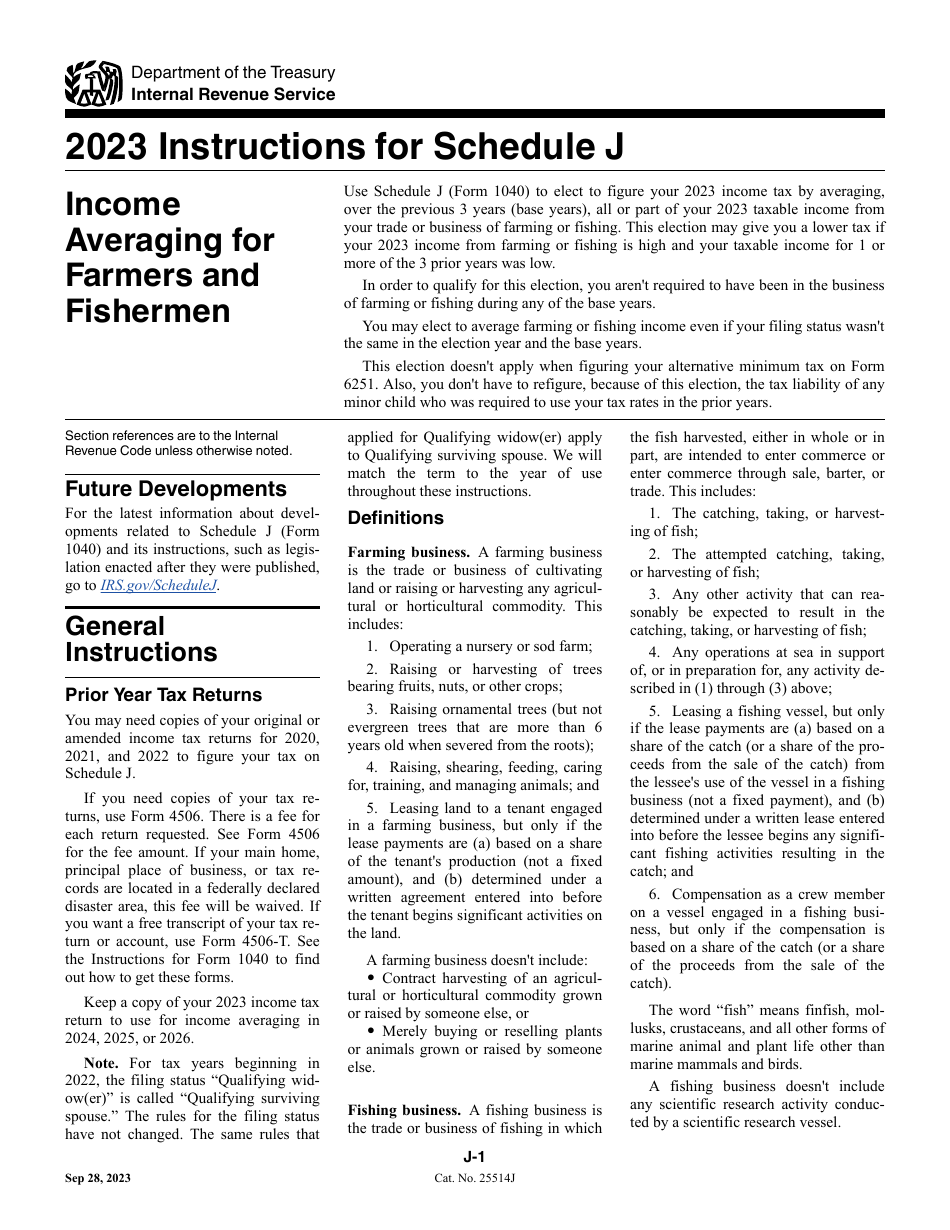

Download Instructions for IRS Form 1040 Schedule J Averaging for, We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

Source: www.templateroller.com

Source: www.templateroller.com

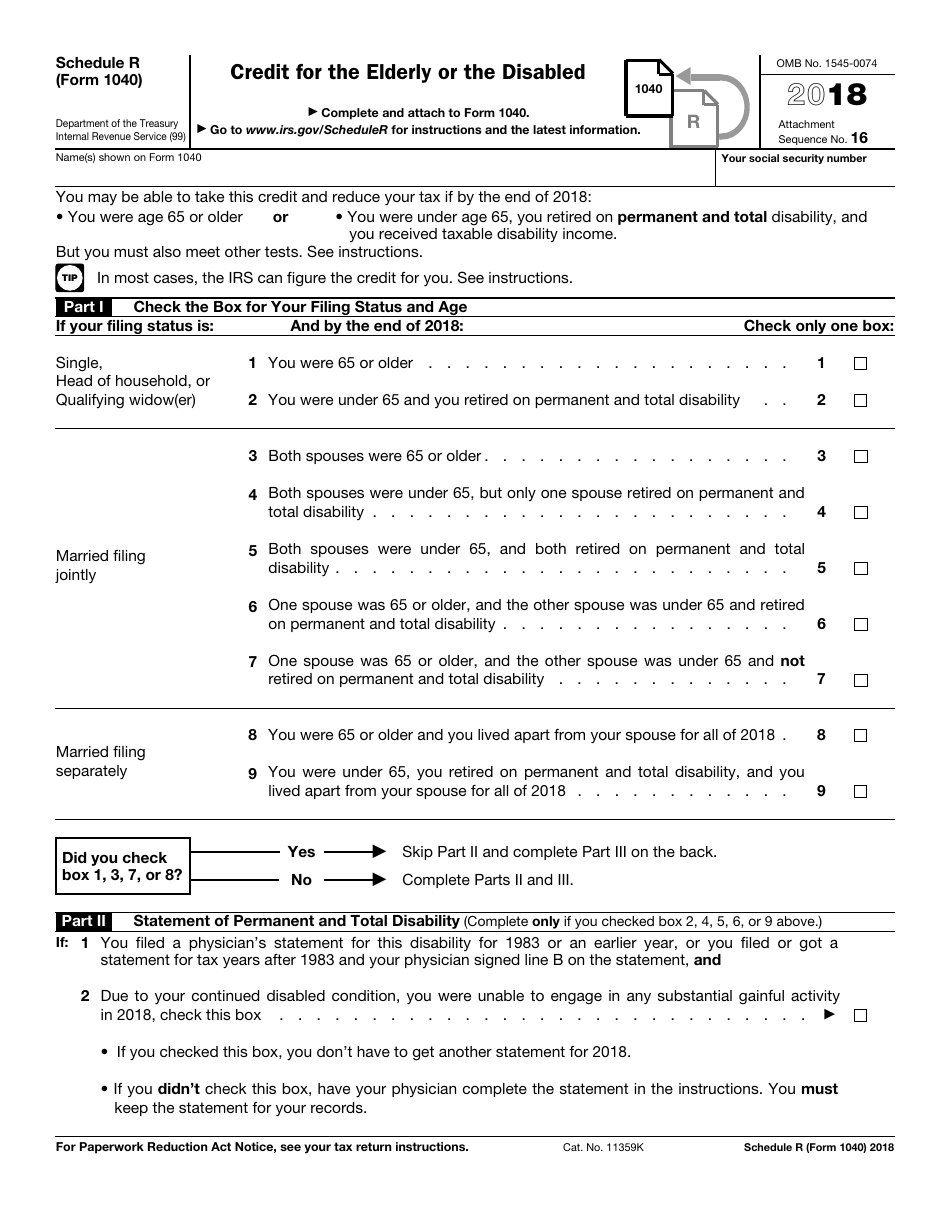

IRS Form 1040 Schedule R 2018 Fill Out, Sign Online and Download, The irs has announced the annual inflation adjustments for the year 2025,.

Source: www.templateroller.com

Source: www.templateroller.com

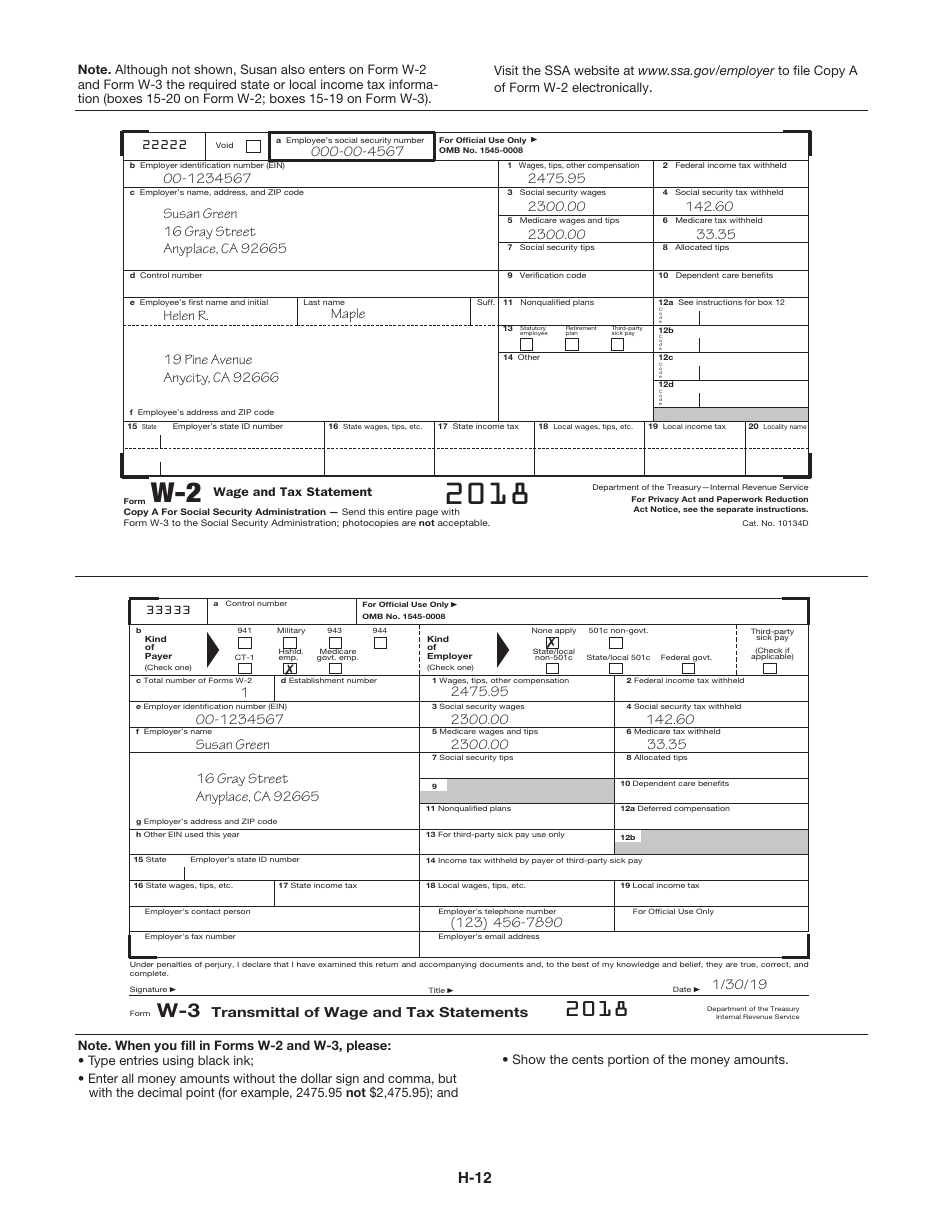

Download Instructions for IRS Form 1040 Schedule H Household Employment, Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics.

Source: viiarmandoblog.blob.core.windows.net

Source: viiarmandoblog.blob.core.windows.net

Irs.gov Form 1040 Schedule B at viiarmandoblog Blog, You can attach your own schedule (s) to report income or loss from any of these sources.

Source: www.taxuni.com

Source: www.taxuni.com

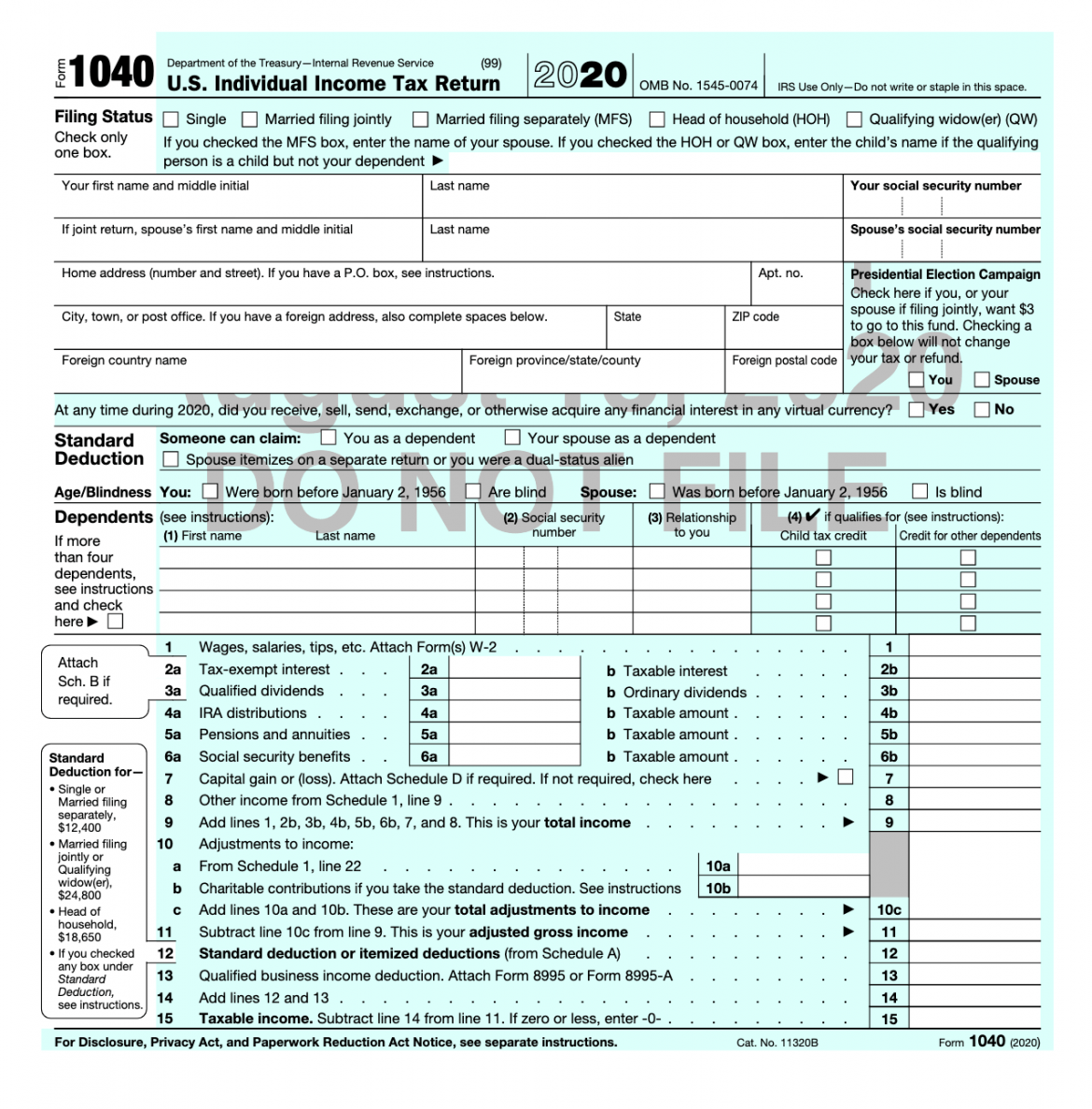

Form 1040 Instructions Booklet 2025 2025, In this blog post, we will focus on how to fill out part i of schedule e for rental.

Source: www.zrivo.com

Source: www.zrivo.com

1040 Form 2025 2025, Why do they need this info?

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 1040 Schedule E Download Fillable PDF or Fill Online, If you earn rental income on a home or building you own, receive royalties or.

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

Irs 1040 Printable Form, The latest versions of irs forms, instructions, and publications.

2025